does wyoming charge sales tax on labor

Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. Does Wyoming charge sales tax on labor.

Sales Tax Laws By State Ultimate Guide For Business Owners

All labor on both tangible.

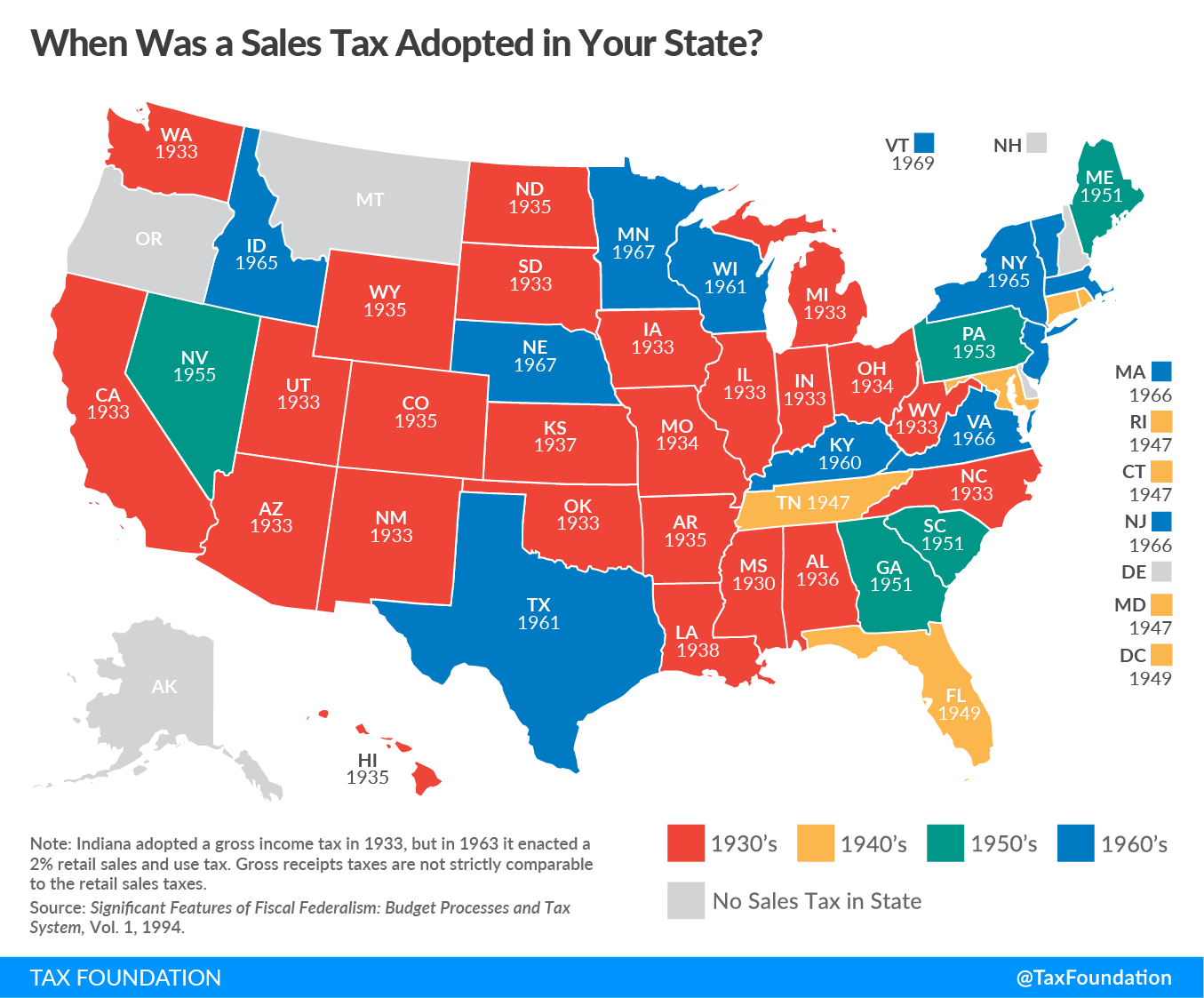

. Currently combined sales tax rates in Wyoming range from 4 to 6 depending on the location of the sale. The use tax rate is not a consumer tax it is a tax that a business pays for storing. Conduct educational seminars throughout the year.

Wyoming does not have an individual income tax. This simply means youll want to have your Point-of-Sales system configured to track sales tax based on your buyers location vs. Wyoming also does not have a corporate income tax.

Provide bulletins publications and other educational material to address. Wyoming has a destination-based sales tax system so you have to pay. In different states the term sales.

If you do not file your sales tax return within 30 days of the due date of your. No you do not pay sales tax on. 11 - What is the 2022 Wyoming Sales Tax Rate.

400 2022 Wyoming state sales tax Exact tax amount may vary for different items The Wyoming state sales tax rate is 4 and the. In Wyoming there are currently no statutory provisions to impose sales or use taxes on professional services provided that they do not include any sales of or repairs. You can look up the local sales tax rate with TaxJars Sales Tax Calculator.

The state-wide sales tax in Wyoming is 4. Wyoming sales tax rate is 4 and the maximum WY sales tax after local surtaxes is 7. No you do not pay sales tax on labor.

If your business has a sales tax nexus in Wyoming you must charge sales tax. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1436 for a total of. So it automatically decreases the cost of living in.

We advise you to check out the Wyoming Department of Revenue. You read it correctly and other tariffs are very convenient to pay. As a business owner selling taxable goods or services you act as an.

Draft formal revenue rulings upon vendor and taxpayer request. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200.

The state sales tax rate in Wyoming is 4. Wyoming charges a late fee that is equal to 10 of the total late sales tax as well as a 1000 late fee. This page discusses various sales tax exemptions in Wyoming.

With lump-sum contracts all materials supplies labor and other charges are. Does minnesota charge sales tax on labor. Business filers pay one or the other.

Wyoming is a Destination-based sales tax state. In the state of Wyoming sales tax is legally required to be collected from all tangible physical products being sold to a consumer and certain services are taxed as well. Wyoming has a use tax that works in conjunction with the sales tax.

In Wyoming when do you have to charge sales tax. In Cheyenne for example the county tax rate is 1 for. However some areas can have a higher rate depending on the local county tax of the area.

Wyoming has a 4 state sales tax with counties adding up to an additional 3 resulting in a maximum rate of 7. But what if we tell you there is no Wyoming income tax rate in Wyoming. There are additional levels of sales tax at local jurisdictions too.

Wyoming Sales Tax Small Business Guide Truic

Faqs Wyoming Department Of Workforce Services

Does Rhode Island Charge Sales Tax On Labor

How Much Does Your State Rely On Sales Taxes Tax Foundation

States With The Highest Lowest Tax Rates

Three Big Problems With The Sales Tax Today Tax Foundation

How To File And Pay Sales Tax In Wyoming Taxvalet

Wyoming Sales Tax Rate Rates Calculator Avalara

Costs Fees To Form And Operate An Llc In Wyoming Simplifyllc

Gold Silver Bullion Collectible State Sales Taxes

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

In Wyoming A Covid 19 Surge A Struggling Energy Economy And A Thriving Haven For The Rich

A Complete Guide To Wyoming Payroll Taxes

Wyoming Clarifies Taxability Of Professional Services Avalara

General Sales Taxes And Gross Receipts Taxes Urban Institute

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)